lotto prizes uk

Lotto, also known as the National Lottery, is one of the most popular forms of gambling in the UK. With its enticing jackpots and various prize tiers, it attracts millions of players every week. This article provides a detailed overview of Lotto prizes in the UK, including how they are structured, the odds of winning, and the tax implications. How Lotto Prizes Are Structured The UK Lotto prize structure is designed to ensure that a significant portion of the ticket sales goes back to the players in the form of prizes.

- Lucky Ace PalaceShow more

- Cash King PalaceShow more

- Starlight Betting LoungeShow more

- Golden Spin CasinoShow more

- Silver Fox SlotsShow more

- Spin Palace CasinoShow more

- Royal Fortune GamingShow more

- Diamond Crown CasinoShow more

- Lucky Ace CasinoShow more

- Royal Flush LoungeShow more

lotto prizes uk

Lotto, also known as the National Lottery, is one of the most popular forms of gambling in the UK. With its enticing jackpots and various prize tiers, it attracts millions of players every week. This article provides a detailed overview of Lotto prizes in the UK, including how they are structured, the odds of winning, and the tax implications.

How Lotto Prizes Are Structured

The UK Lotto prize structure is designed to ensure that a significant portion of the ticket sales goes back to the players in the form of prizes. Here’s a breakdown of how the prizes are distributed:

1. Jackpot (Match 6 Numbers)

- The jackpot is the top prize and is awarded to players who match all six main numbers drawn.

- The jackpot starts at £2 million and can roll over to subsequent draws if not won, potentially reaching tens of millions of pounds.

2. Match 5 Numbers + Bonus Ball

- Players who match five main numbers plus the bonus ball win a substantial prize, typically in the range of £100,000 to £500,000.

3. Match 5 Numbers

- Matching five main numbers without the bonus ball still awards a significant prize, usually around £1,750.

4. Match 4 Numbers

- Matching four numbers wins a prize of approximately £140.

5. Match 3 Numbers

- Matching three numbers is the minimum requirement to win a prize, which is typically £30.

6. Match 2 Numbers

- While not a cash prize, matching two numbers entitles players to a free Lucky Dip for the next draw.

Odds of Winning

Understanding the odds of winning can help players manage their expectations and make informed decisions. Here are the odds for each prize tier:

- Jackpot (Match 6 Numbers): 1 in 45,057,474

- Match 5 Numbers + Bonus Ball: 1 in 7,509,579

- Match 5 Numbers: 1 in 144,415

- Match 4 Numbers: 1 in 2,180

- Match 3 Numbers: 1 in 97

- Match 2 Numbers: 1 in 10.3

Tax Implications

One of the significant advantages of playing the UK Lotto is that all prizes, regardless of the amount, are tax-free. This means that winners do not have to pay income tax, capital gains tax, or any other form of tax on their winnings.

How to Claim Your Prize

Winners have varying timeframes to claim their prizes, depending on the amount won:

- £500 or less: Prizes can be claimed at any National Lottery retailer.

- £501 to £30,000: Prizes can be claimed at a National Lottery Post Office or by post.

- £30,001 and above: Prizes must be claimed at a designated National Lottery office.

Additional Draws and Prizes

In addition to the main Lotto draw, there are several supplementary draws and games that offer additional prize opportunities:

- Lotto HotPicks: Offers fixed cash prizes for matching fewer numbers.

- Thunderball: Features a separate draw with its own jackpot and prize tiers.

- Set for Life: Offers a unique prize structure where winners receive a fixed amount of money every month for 30 years.

Responsible Gambling

While Lotto can be an exciting and potentially life-changing experience, it’s essential to gamble responsibly. The National Lottery provides resources and support for those who may need help managing their gambling habits.

The UK Lotto offers a diverse range of prize tiers, making it accessible to players with different levels of risk tolerance. With tax-free winnings and the potential for life-changing jackpots, it’s no wonder that Lotto remains a beloved pastime for millions of Britons. Whether you’re playing for fun or with the hope of hitting the jackpot, understanding the prize structure and odds can enhance your Lotto experience.

casino uk

The United Kingdom has a rich history and vibrant culture surrounding gambling, with the casino scene being a significant part of this tradition. From luxurious land-based casinos to the convenience of online platforms, the UK offers a diverse and exciting gambling experience. This article delves into the various aspects of the UK casino scene, providing insights into its history, regulations, popular games, and the future of gambling in the country.

History of Casinos in the UK

Early Beginnings

- 19th Century: Gambling in the UK dates back to the 19th century, with the first legal casino, Crockford’s Club, opening in London in 1828.

- 20th Century: The Betting and Gaming Act of 1960 paved the way for the establishment of the first modern casinos in the UK.

Modern Era

- 1968: The introduction of the Gaming Act allowed for larger casinos with more games, leading to the growth of the industry.

- 2005: The Gambling Act further liberalized the industry, allowing for more casinos and online gambling platforms.

Land-Based Casinos in the UK

Major Casinos

- The Hippodrome Casino, London: Known for its grandeur and variety of games, including poker, roulette, and baccarat.

- Grosvenor Casino, Various Locations: A chain of casinos offering a wide range of games and entertainment options.

- Aspers Casino, Stratford: One of the largest casinos in the UK, featuring a vast array of slot machines and table games.

What to Expect

- Games: Popular games include roulette, blackjack, baccarat, poker, and electronic slot machines.

- Atmosphere: A mix of sophistication and excitement, with a focus on providing a premium experience.

- Dress Code: While some casinos have strict dress codes, others are more relaxed, so it’s advisable to check beforehand.

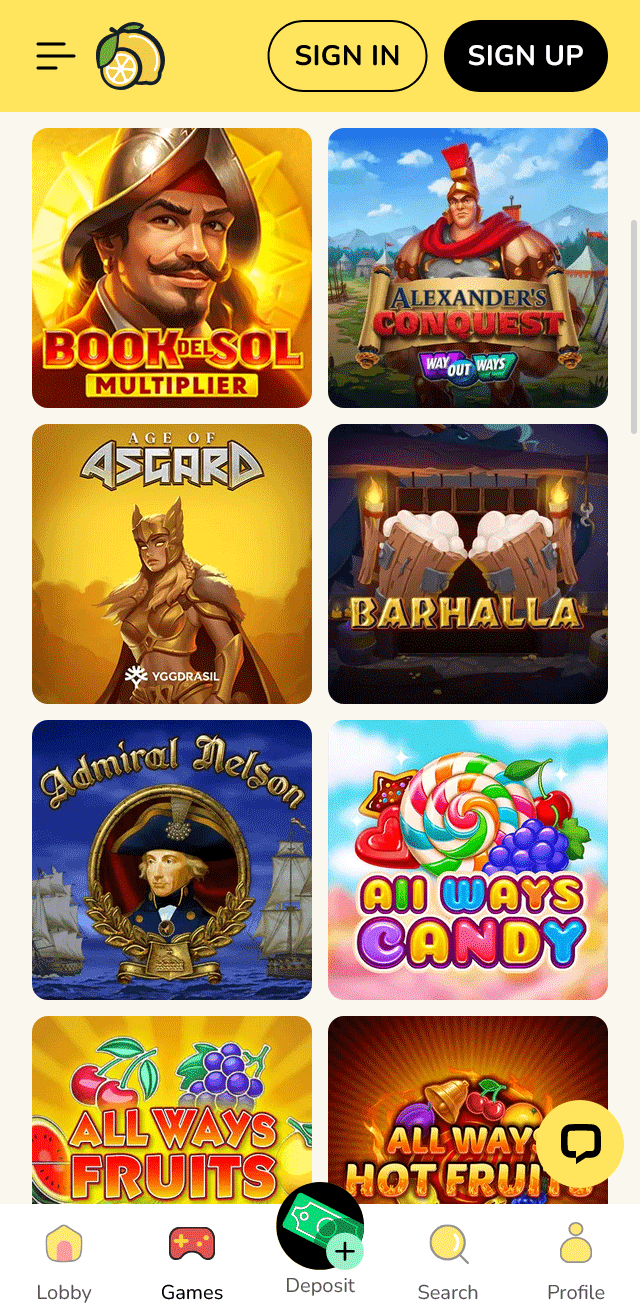

Online Casinos in the UK

Popular Platforms

- Bet365: Known for its extensive sports betting options and casino games.

- 888 Casino: Offers a wide variety of games, including live dealer options.

- LeoVegas: Renowned for its mobile-friendly platform and generous bonuses.

Advantages of Online Casinos

- Convenience: Play from the comfort of your home or on the go.

- Variety: Access to a broader range of games, including exclusive online titles.

- Bonuses: Attractive welcome bonuses and ongoing promotions.

Regulatory Framework

Licensing and Compliance

- Gambling Commission: The primary regulatory body overseeing gambling activities in the UK.

- Licensing: All casinos, both land-based and online, must obtain a license from the Gambling Commission.

- Responsible Gambling: Measures include age verification, self-exclusion options, and deposit limits.

Recent Developments

- 2019 Point of Consumption Tax: A 21% tax on gross gambling revenue for online operators.

- Advertising Regulations: Stricter rules on advertising, particularly targeting vulnerable groups.

Popular Casino Games in the UK

Table Games

- Roulette: Classic game with various betting options.

- Blackjack: Strategy-based game with a low house edge.

- Baccarat: High-stakes game popular among VIP players.

Electronic Games

- Slot Machines: Wide variety of themes and payout structures.

- Video Poker: Combines elements of poker and slot machines.

Live Dealer Games

- Evolution Gaming: Leading provider of live dealer games, offering roulette, blackjack, and baccarat with real dealers.

- Authentic Gaming: Specializes in live roulette streamed from real casinos.

The Future of Gambling in the UK

Technological Advancements

- Virtual Reality (VR): Potential for immersive casino experiences.

- Artificial Intelligence (AI): Enhanced personalization and security.

Social and Ethical Considerations

- Problem Gambling: Continued focus on prevention and support.

- Sustainability: Increasing emphasis on responsible gambling practices.

The UK casino scene continues to evolve, offering a blend of tradition and innovation. Whether you prefer the glamour of land-based casinos or the convenience of online platforms, the UK provides a diverse and exciting gambling experience for all.

is internet betting legal? a comprehensive guide to online gambling regulations

The legality of internet betting, or online gambling, varies significantly across different countries and regions. Understanding the regulatory landscape is crucial for both operators and consumers. This guide aims to provide a comprehensive overview of online gambling regulations worldwide.

Global Overview

1. United States

- Federal Level: The Unlawful Internet Gambling Enforcement Act (UIGEA) of 2006 prohibits financial institutions from processing transactions related to online gambling. However, it does not make online gambling itself illegal.

- State Level: Each state has its own regulations. For example, Nevada, New Jersey, and Pennsylvania have legalized online gambling, while others like Utah and Hawaii have strict bans.

2. European Union

- EU Framework: The EU allows member states to regulate online gambling individually, but there are common principles such as the free movement of services and consumer protection.

- Country Examples:

- United Kingdom: Fully regulated with the UK Gambling Commission overseeing online gambling activities.

- Germany: The Interstate Treaty on Gambling restricts online casino games but allows sports betting.

- Spain: Individual regions regulate online gambling, with a national framework ensuring consistency.

3. Asia

- China: Online gambling is illegal, with strict penalties for both operators and players.

- Japan: Online sports betting is legal, but casino games are not.

- India: The legality varies by state. Some states have legalized online betting, while others have strict bans.

4. Australia

- Federal Regulation: The Interactive Gambling Act (IGA) 2001 prohibits online casinos and poker sites from offering services to Australian residents. However, sports betting is allowed.

5. South America

- Argentina: Each province has its own regulations. Buenos Aires and Córdoba allow online gambling, while others do not.

- Brazil: Online gambling is illegal, but there are discussions about potential legalization.

Key Regulatory Considerations

1. Licensing and Compliance

- Licensing Authorities: Operators must obtain licenses from relevant authorities, such as the UK Gambling Commission or the Malta Gaming Authority.

- Compliance: Operators must adhere to strict regulations regarding fair play, responsible gambling, and data protection.

2. Taxation

- Tax Rates: Vary significantly by jurisdiction. For example, the UK imposes a 15% point of consumption tax on online gambling operators.

- Reporting: Operators must report revenues and pay taxes according to local laws.

3. Consumer Protection

- Age Verification: Operators must ensure that players are of legal age to gamble.

- Problem Gambling Measures: Regulations often require operators to implement measures to prevent and address problem gambling, such as deposit limits and self-exclusion options.

4. Advertising and Marketing

- Restrictions: Many jurisdictions impose strict rules on advertising, particularly targeting vulnerable groups like minors.

- Transparency: Operators must provide clear and accurate information about their services and terms.

Challenges and Future Trends

1. Cross-Border Regulation

- Jurisdictional Conflicts: Regulating online gambling across borders can be challenging due to differing legal frameworks.

- International Cooperation: Increasingly, countries are working together to create a more harmonized regulatory environment.

2. Technological Advancements

- Cryptocurrency: The use of cryptocurrencies in online gambling raises new regulatory challenges regarding transparency and consumer protection.

- AI and Machine Learning: These technologies can enhance compliance and consumer protection but also require careful regulation.

3. Public Perception and Policy Changes

- Social Responsibility: Public opinion and social responsibility campaigns can influence policy changes.

- Economic Impact: The economic benefits of legalized online gambling, such as job creation and tax revenue, can drive policy decisions.

Understanding the complex and evolving landscape of online gambling regulations is essential for anyone involved in the industry. By staying informed and compliant with local and international laws, operators can ensure a safe and fair environment for consumers.

Gambling Taxes

Gambling has long been a popular form of entertainment, with millions of people engaging in various forms of betting, from football betting to casino games like baccarat and electronic slot machines. However, one aspect that often goes overlooked is the taxation of gambling winnings. Understanding gambling taxes is crucial for both recreational and professional gamblers to ensure they comply with legal obligations and avoid potential penalties.

Types of Gambling Taxes

Gambling taxes can be broadly categorized into two types: income tax on winnings and specific gambling taxes imposed by governments.

1. Income Tax on Winnings

Income tax on gambling winnings is a common form of taxation in many countries. Here’s how it works:

- Taxable Winnings: Any amount won through gambling activities is considered taxable income. This includes winnings from casinos, sports betting, lotteries, and other forms of gambling.

- Reporting Requirements: Gamblers are required to report their winnings on their tax returns. The amount reported should be the net winnings, which is the total amount won minus the amount wagered.

- Tax Rates: The tax rate applied to gambling winnings varies depending on the country and the individual’s overall income. In some cases, gambling winnings may be subject to a flat tax rate.

2. Specific Gambling Taxes

In addition to income tax on winnings, some governments impose specific gambling taxes on operators and establishments. These include:

- Casino Taxes: Governments may levy taxes on casino revenues, which can be a percentage of the total income generated by the casino.

- Sports Betting Taxes: Similar to casino taxes, sports betting operators may be required to pay a tax on the total amount wagered or the profits generated.

- Lottery Taxes: Governments often impose taxes on lottery operators, which can be a significant source of revenue.

Taxation in Different Jurisdictions

The taxation of gambling winnings and operations varies significantly across different countries and jurisdictions. Here are some examples:

United States

- Federal Tax: In the U.S., gambling winnings are subject to federal income tax. The tax rate depends on the individual’s overall income.

- State Tax: Some states also impose their own taxes on gambling winnings, which can vary widely. For example, states like Nevada and New Jersey have different tax rates for casino winnings.

United Kingdom

- No Tax on Winnings: In the UK, gambling winnings are not subject to income tax. However, operators are required to pay taxes on their revenues.

Australia

- Tax on Professional Gamblers: In Australia, professional gamblers are required to pay income tax on their winnings. Recreational gamblers, however, do not pay tax on their winnings.

Tips for Managing Gambling Taxes

To ensure compliance and minimize tax liabilities, here are some tips for managing gambling taxes:

- Keep Detailed Records: Maintain detailed records of all gambling activities, including winnings, losses, and wagers. This documentation is essential for accurate tax reporting.

- Deductible Losses: In some jurisdictions, gambling losses can be deducted from winnings to reduce taxable income. Ensure you have proper documentation to support these deductions.

- Consult a Tax Professional: Given the complexity of gambling taxes, it is advisable to consult a tax professional who specializes in this area. They can provide guidance on reporting requirements and potential deductions.

Gambling taxes are an important consideration for anyone involved in betting activities. Whether you are a casual gambler or a professional, understanding the tax implications can help you stay compliant and manage your finances effectively. By keeping accurate records and seeking professional advice, you can navigate the complexities of gambling taxes with confidence.

Source

- lotto prizes uk

- lotto prizes uk

- online gambling slots uk

- what is the best online gambling site uk

- online gambling slots uk

- what is the best online gambling site uk

Frequently Questions

What are the latest Lotto prizes available in the UK?

The latest Lotto prizes in the UK offer substantial rewards, including the jackpot, which starts at £2 million and can roll over to create larger prizes. Other prizes range from matching three main numbers for a fixed £30, up to matching five main numbers plus the bonus ball for £1 million. The Lotto draws take place twice a week, providing multiple chances to win. Additionally, the Lotto HotPicks game offers prizes from £6 for matching one number, to £350,000 for matching all five numbers. These prizes are subject to change, so it's advisable to check the National Lottery's official website for the most current information.

How do UK Lotto prizes compare to other countries?

UK Lotto prizes are competitive on the global stage, offering substantial jackpots that can rival those in other major lotteries. For instance, the UK National Lottery's main draw frequently features multi-million-pound jackpots, which can compare favorably with the EuroMillions and US Powerball. However, prize structures can vary significantly; while some countries like the US may offer larger individual jackpots, the UK Lotto's system of distributing smaller prizes more frequently can enhance overall player satisfaction. Additionally, UK Lotto's charitable contributions set it apart, making it a socially responsible option among global lotteries.

How do the Irish Lotto and UK Lotto compare in terms of rules and prizes?

The Irish Lotto and UK Lotto share similarities in structure but differ in specifics. Both involve selecting numbers from a pool, with the Irish Lotto requiring six numbers from 1 to 47 and the UK Lotto, six from 1 to 59. The Irish Lotto offers a fixed jackpot, while the UK Lotto's jackpot can roll over, potentially reaching higher amounts. Prize tiers also vary; the Irish Lotto has seven, including a bonus ball, whereas the UK Lotto has six, with an additional bonus ball. Both lotteries contribute to charitable causes, but the Irish Lotto focuses more on local initiatives, while the UK Lotto supports a broader range of national projects.

What Are the Rules and Mechanics of the UK Lotto?

The UK Lotto, operated by Camelot, involves selecting six numbers from 1 to 59. Draws occur twice weekly, offering a jackpot that rolls over if not won. Players can enhance their chances with 'Lotto Extra' and 'Millionaire Raffle'. Tickets cost £2, with additional fees for supplementary games. Winners are determined by matching numbers, with prizes ranging from free tickets to millions. Players must be 16 or older. Taxes are not levied on winnings, and prizes are paid in a lump sum. The game aims to raise funds for various charitable causes across the UK.

How are the UK Lotto prizes distributed in the latest results?

In the latest UK Lotto results, prizes are distributed across multiple tiers based on the number of matching numbers. The jackpot, the highest prize, is awarded to players who match all six main numbers. Additional prize tiers include matching five main numbers plus the bonus ball, five main numbers, four main numbers, and three main numbers, each with progressively smaller prizes. The prize fund is a percentage of ticket sales, ensuring that winners receive a fair share. For the most accurate and detailed prize distribution, always refer to the official UK Lotto website or authorized news sources.